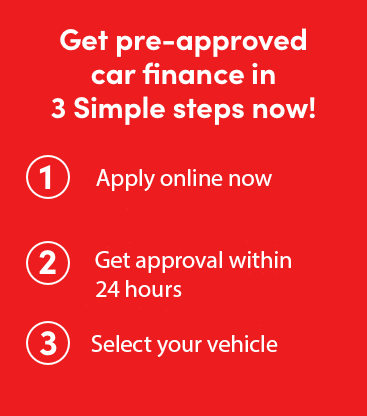

Let's get started

- 1 Personal Details

- 2 Address & Employment

Frequently Asked Questions

Absolutely. We can help business owners/self-employed people with their car finance.

We keep it simple and generally only need two things: 1. Proof of income and 2. Driver’s license.

We often provide car finance with no deposit. When you speak to our finance team, we will be able to give you the figures then you need to decide how much deposit you want to pay.

Yes. A valid NZ learner’s licence is acceptable for starting a loan application, we may ask for a guarantor or restricted driver licence booking.

A guarantor might be requested if your affordability is low or you have had bad or any issues with the credit. Applicants under 21 may be asked to provide a guarantor to improve their eligibility.

Our rates are often better than the banks and other finance companies so it is definitely worth talking to the Motor Co finance before signing on the dotted line with someone else.

You will be amazed once you find out how much money we can save you.

We provide Mechanical & Electrical Breakdown Insurance, Guaranteed Asset Protection Insurance Cover, Payment Protection Insurance, Motor Vehicle Insurance and 24/7 Roadside Assistance cover.

Our terms are very flexible, ranging from 1 to 5 years.

Yes, you need to be at least 18 years of age.

You may not need to have any previous credit history. However, we may ask for some deposit or guarantor in some cases.

The security will be the car you have purchased.

Absolutely. We may need a deposit in some cases.

Absolutely. You can choose to pay weekly, fortnightly, or monthly.